Direct Debit manager

Letting customers manage their existing Direct Debit (DD) payment arrangement, and providing detailed and understandable explanations for how we calculate these.

Initiative overview

Background

A large retail energy supplier, taking over 200,000 voice calls and 60,000 chats every week. Many customers pay by regular Direct Debit rather than on receipt of a bill, often as a way to spread out their costs or to recover their debts. This is consistently in the top 5 reasons for customer contact.

Problems & opportunities

- Many contacts from customers about their DD were over 10 minutes long, and of inconsistent accuracy and quality

- A significant amount of contacts were purely transactional, for example changing their payment date or bank details—customers had to queue for a long time for a 30 second change to their account!

- DD is the preferred payment method for the business as it improves cash-flow, and reduces customer “winter bill shock” by spreading seasonal cost variations out over the year

- How do we handle customers who aren’t currently on Direct Debit?

Solution

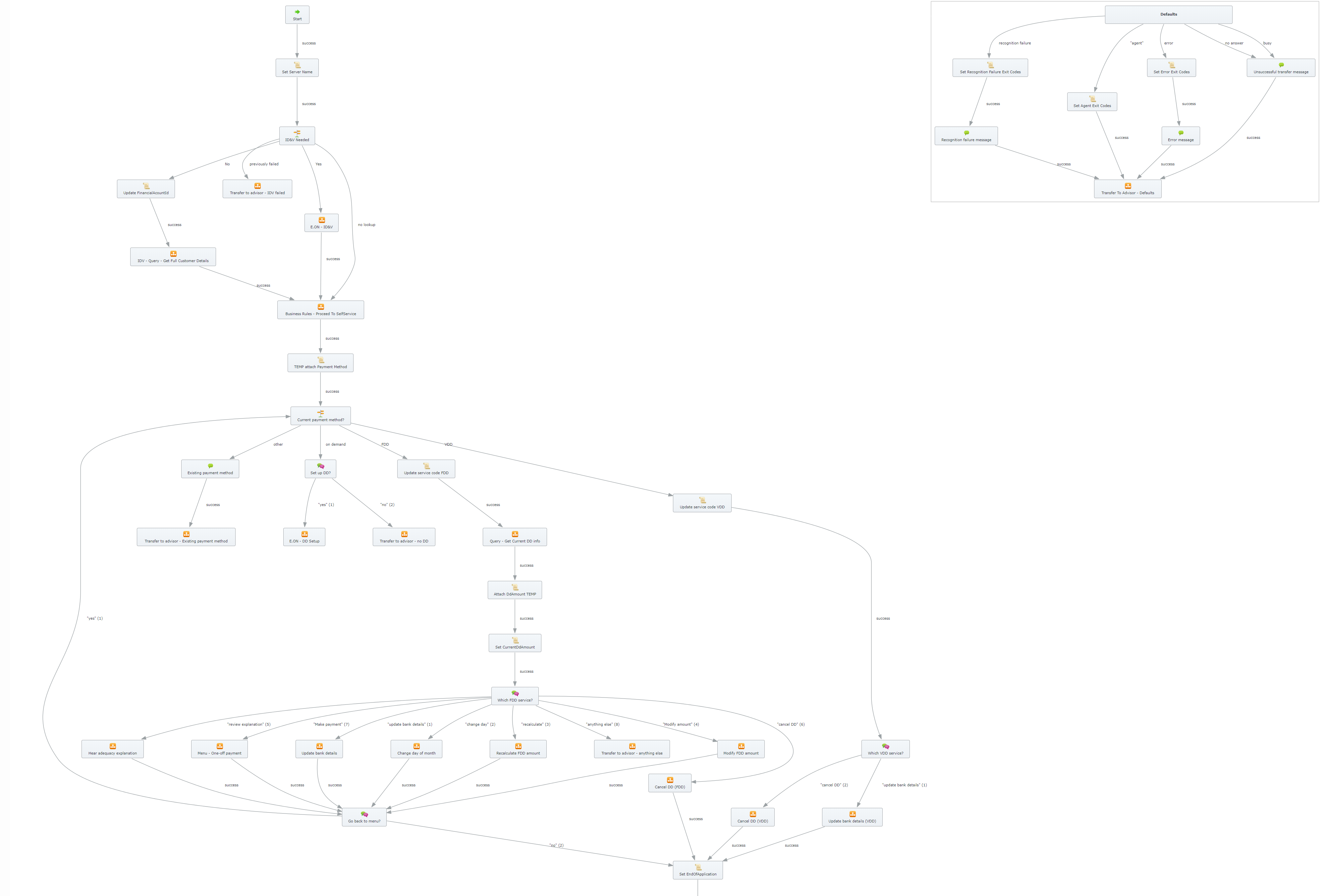

A suite of micro-apps to satisfy a variety of Direct Debit related account tasks and support queries, available across all main channels.

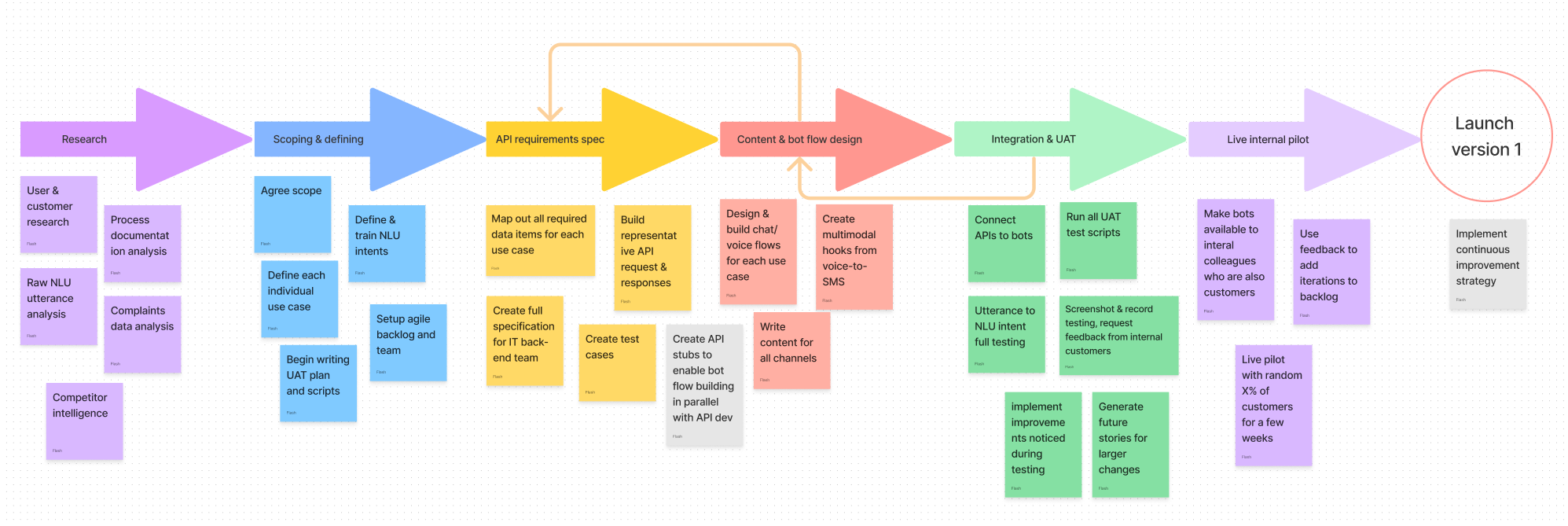

Delivery approach

I identified early on that this wasn’t one service or bot, instead a number of smaller ones. During the research and scoping phases we isolated a series of micro-apps and associated micro-service APIs that could all operate independently.

| Micro-app | Description |

|---|---|

| Hear explanation | The most complex and most valuable one. For customers paying monthly, this bot explains how we calculate their monthly average. This can include up to 25 potential factors, including predicted energy usage, historic debt, pending refunds, etc. The explanation had to be accurate but simple—and the customer has the option to drill into more detail, and receive and SMS or email with the full information |

| One-off payment | Some customers prefer to pay off some of a large bill, and get a recalculated monthly payment amount |

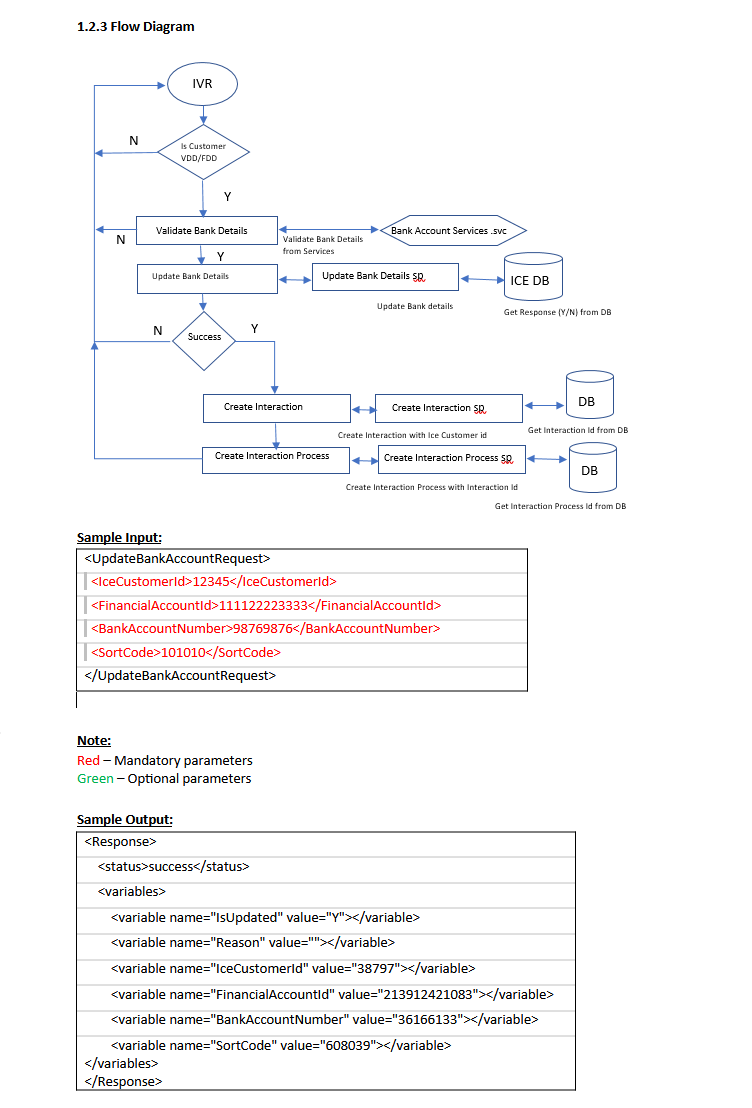

| Update bank details | If the customer moves their bank, this lets them update to a valid bank account and sort code |

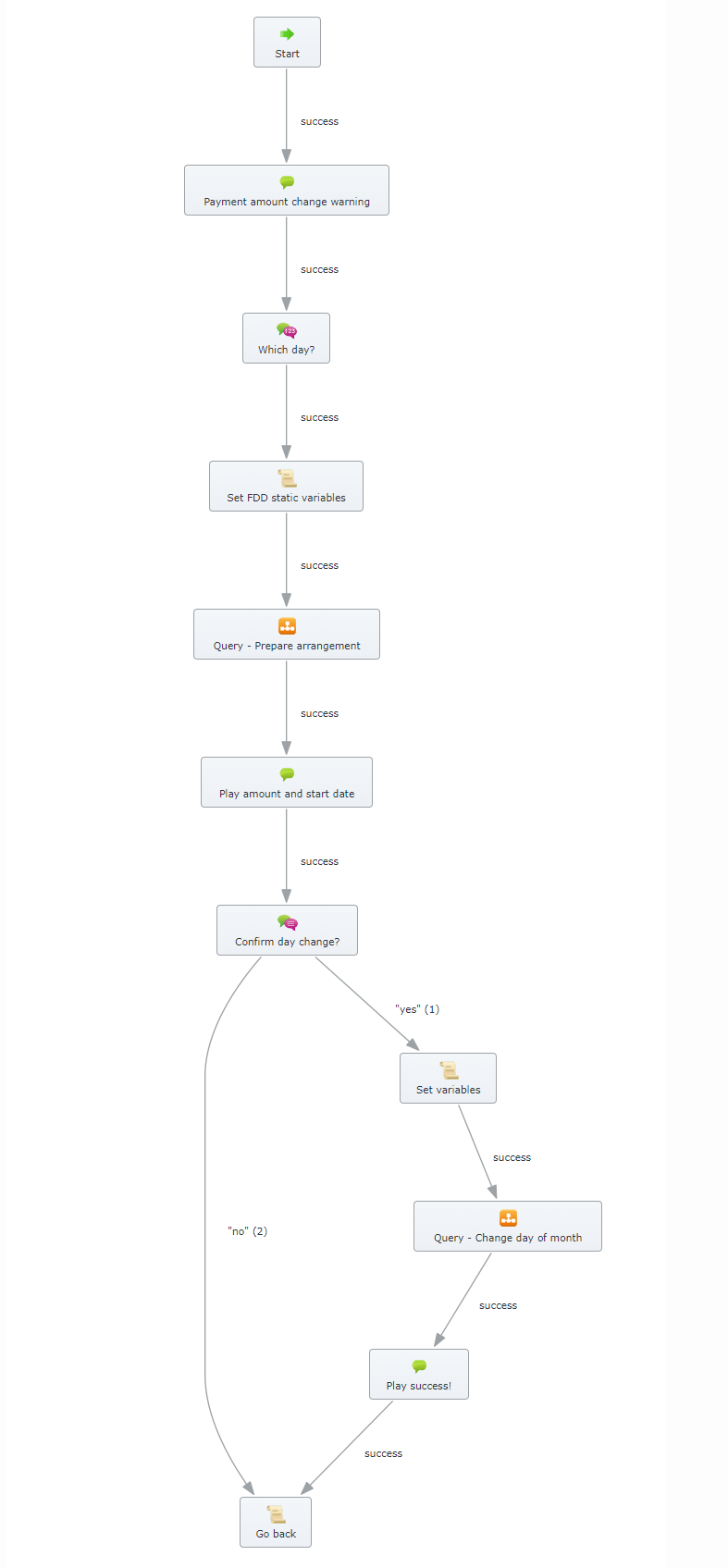

| Change day of month | If the customer gets a new job, for example, with a new payday—this lets them update the day of each month we take their payment |

| Recalculate amount | We review payments automatically each year, this lets a customer get an immediate recalculation. This bot integrates with the meter reading & billing bots when we need more up-to-date details |

| Override payment amount | In some cases, the customer may wish to override our calculations—e.g. if their property is going to be vacant for a while, or perhaps they expect their energy use to increase when a baby is born. This lets them temporarily override the default, within defined business rules |

| Cancel DD | Allows customers to switch back to paying manually on receipt of their bill |

| Change debt recovery | For those with a debt component, this lets them flex the duration of recovery, or the monthly amount they’re paying—especially for customers who are struggling to cover their current amount |

Challenges

- Some information provided is necessarily long or complex, in the voice channel how do we ensure the customer understands this?

- How do we handle ambiguous NLU queries such as “It’s about my Direct Debit” or “I want to change my monthly payments”?

- How does the digital bot co-exist with or complement similar web and app-native functionality?

- How do we seamlessly hand off back-and-forth between other existing bots (e.g. meter reads & billing, or card payment) where that’s required as part of the journey?

API specification process

Using agent call recordings, chat transcripts, CRM system screens and documented business processes I worked with our backend developers to map out all of the micro-services I needed and the data items + actions for each of these.

This was done in parallel with the early conversation design for each bot, which then allowed the API developers and bot dialog flow developers to work in parallel for a faster delivery.

Benefits

- 65% of customer contacts related to Direct Debit fully contained in automation

- 28 percentage point NPS increase from customers using the DD manager bots vs. agent-handled contacts

- 50% reduction in repeat contacts when going through the bots, compared to agent-handled contacts

Genesys Intelligent Automation – flow samples